NVIDIA announced its fourth-quarter and fiscal year earnings ending January 28, 2024. Fourth-quarter revenue was $22.1 billion, compared to $6.051 billion in the same period last year, representing a 265% year-over-year increase and a 22% sequential increase. Data center revenue for the quarter was $18.4 billion, a 409% increase year-over-year and a 27% increase sequentially. Quarterly net profit was $12.285 billion, compared to $1.414 billion in the same period last year, marking a 769% increase year-over-year and a 33% increase sequentially. Fiscal year revenue was $60.922 billion, compared to $26.974 billion in the previous fiscal year. Fiscal year net profit was $29.76 billion, compared to $4.368 billion last year.

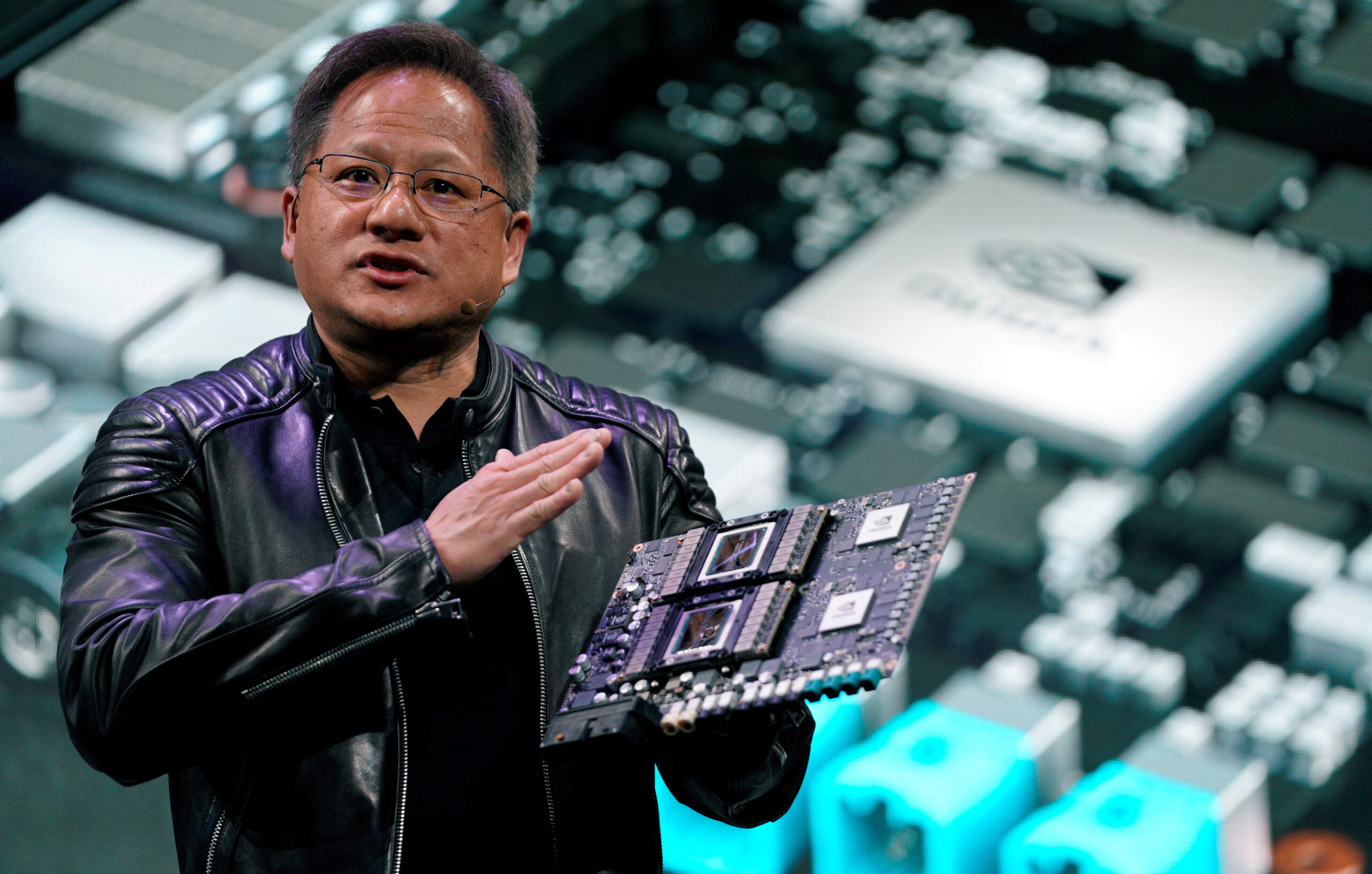

FILE PHOTO: Jensen Huang, CEO of Nvidia, shows the Drive Pegasus robotaxi AI computer at his keynote address at CES in Las Vegas, Nevada, U.S. January 7, 2018. REUTERS/Rick Wilking/File Photo

This financial windfall highlights NVIDIA’s unassailable position at the forefront of technological innovation, particularly in the realms of computing and artificial intelligence. The company’s success is a testament to its strategic vision and execution, capturing the burgeoning demand for advanced processing capabilities in a world increasingly driven by data.

The implications of NVIDIA’s financial success extend far beyond its shareholders. This growth narrative is a beacon for the entire tech industry, signaling robust health and the potential for groundbreaking advancements in AI, machine learning, and beyond.

For tech enthusiasts, investors, and industry watchers, NVIDIA’s record-breaking earnings are more than just numbers. They represent the pulse of technological progress and the endless possibilities that lie ahead. As we stand on the brink of a new era in tech, NVIDIA’s achievements offer a glimpse into a future shaped by unprecedented computational power and intelligence.

Get Your Free Linux training!

Join our free Linux training and discover the power of open-source technology. Enhance your skills and boost your career! Learn Linux for Free!AI news

Google announced the launch of Gemma, the world’s most powerful and lightweight open-source model series, in two sizes: 2B (2 billion parameters) and 7B (7 billion parameters). The 2B version can even run directly on laptops. Developed by Google DeepMind and other Google teams, Gemma uses the same research and technology as the Gemini model. Google claims that in 18 key benchmarks in language understanding, reasoning, mathematics, etc., Gemma’s scores exceeded those of larger parameter open-source models like Meta Llama-2 in 11 tests.

Apple reorganized the leadership of the hardware team responsible for the audio functions of AirPods, Mac, and other products, appointing a new leader for this increasingly important business. Gary Geaves, who long served as the company’s vice president in charge of sound, will step down, and his position will be taken over by his top deputy, Ruchir Dav. This leadership change adds to the turbulence in Apple’s hardware engineering department, led by John Ternus. Tang Tan, vice president responsible for the design of the iPhone, Apple Watch, and AirPods, recently left the company. Geaves’ team was transferred to Matt Costello, an executive in charge of Beats headphones and HomePod, last December.

IDC’s report shows that China’s tablet market shipped approximately 8.17 million units in the fourth quarter of 2023, a year-over-year decline of about 5.7%, with the consumer market down 7.3% and the commercial market up 13.8%. Huawei surpassed Apple for the first time in China’s tablet market shipments, reaching a market share of 30.8%, with Apple at 30.5%. This marks the first time since 2010 that the top brand in China’s quarterly tablet shipments has changed. For the entire year of 2023, Apple still led in shipments with a 33.5% market share, followed by Huawei at 26.5%, with Xiaomi, Honor, and Lenovo ranking third to fifth.

German appliance giant Miele will cut 2,000 jobs globally and move about 700 jobs from Germany to Poland. Miele has 15 production bases worldwide and more than 23,000 employees, with over 11,000 in German factories alone. The job cuts represent 10% of its workforce.

Disney has reached an agreement with Sony Group to hand over most of its DVD and Blu-ray disc sales business in the US and Canada to Sony, transforming this rapidly declining business in recent years. As more people watch movies and TV shows online, the DVD business is shrinking, making it harder for each movie company to profit. Last year, Disney stopped selling discs in some markets, including Australia and New Zealand. The sale of videotapes and DVDs was once a huge and profitable business for Disney.

FuboTV, a streaming service focusing on sports content, sued a media company planning to launch a new sports streaming platform this fall, accusing them of not allowing Fubo to broadcast a small portion of sports-centric channels they are now seeking to include in the new service. The lawsuit, filed in the U.S. District Court for the Southern District of New York on Tuesday, aims to stop a joint venture between Fox Corporation, Warner Bros. Discovery, and The Walt Disney Company, the parent company of ESPN. The lawsuit also seeks a jury trial and punitive damages.

Benefiting from holding 90% of Arm, a chip design company heavily involved in the AI boom, Japan’s SoftBank Group has taken a leading position in the AI industry. Since Arm announced better-than-expected earnings this month, its stock price has risen by 67%. Investors are betting that Arm will also benefit from its chip designs being increasingly used in data centers. SoftBank’s stock price has increased by 29%. Although Arm’s profit outlook indeed exceeded analysts’ expectations, the rise in its stock price is also partly due to a limited number of shares available for trading. After this surge, the market value of SoftBank’s Arm shares ($118 billion) is now significantly higher than SoftBank’s own market value ($84 billion).

Samsung Electronics announced on Wednesday that it will expand its collaboration with Arm, a British chip design company under SoftBank Group, to enhance the competitiveness of its foundry business. This will allow Samsung Electronics’ fabless clients more opportunities to access the most advanced GAA processes, minimizing the time and cost of developing next-generation products. GAA technology is a next-generation key semiconductor technology that improves data processing speed and power efficiency by addressing the performance degradation of transistors due to process miniaturization.

Samsung Electronics disclosed in an audit report on the 21st that it sold its remaining shares in ASML, a Dutch semiconductor equipment manufacturer, totaling 1.580407 million shares (0.4% stake), valued at approximately 1.2 trillion Korean won. Samsung Electronics had originally purchased about 3% of ASML’s shares in 2012 for about 700 billion Korean won for future lithography machine development cooperation. Samsung Electronics sold a 1.3% stake in 2016 and began selling the remaining shares from the second quarter of last year. The return on this investment is estimated to be about eightfold. The sale of ASML shares by Samsung Electronics was aimed at addressing funding issues for semiconductor process technology upgrades.

Tesla’s Chinese rival Xpeng announced it will increase investment and hire thousands of new employees to survive the “bloody” competition. Xpeng’s CEO, He Xiaopeng, stated that the company, supported by Volkswagen, will add 4,000 employees and invest 3.5 billion yuan in autonomous driving and artificial intelligence technologies.

Amazon.com will officially join the Dow Jones Industrial Average on Monday, replacing Walgreens Boots Alliance. This adjustment, triggered by Walmart’s 1-for-3 stock split effective next week, was announced by S&P Dow Jones Indices, which manages the Dow. Walmart’s stock split will reduce its weight in the Dow and also lower the weight of consumer staples stocks. The Dow is calculated by adding the prices of its 30 components and then dividing by a divisor that accounts for stock splits and the addition of new stocks.

HSBC significantly reduced its exposure to commercial real estate in the US and UK last year, indicating that the banking industry is striving to limit losses amid persistently high vacancy rates in major city office buildings. The bank’s current US commercial real estate investment portfolio is less than half its pre-pandemic size. Disclosure documents reveal that HSBC’s exposure to the US real estate market decreased by 27% to $3.9 billion last year, the highest drop among all regions. Europe’s largest bank reported declines in commercial real estate loans in every market, with a 12% decrease in Asia, 6% in the UK, 13% in the Middle East, and an overall 13% decrease in its global real estate loan portfolio to $83.6 billion.

Norsk Hydro, Europe’s largest aluminum producer, warned that the construction industry in some major European countries is experiencing a demand slump similar to that during the COVID-19 crisis. The CFO of Europe’s largest aluminum producer stated that the construction industry is collapsing due to high interest rates and rising construction costs, severely impacting the aluminum industry and harming the earnings of Hydro and its competitors.